The Science Behind Prop Firm Challenges: How to Build Profitable and Engaging Models

- 10-12 min

- Barbara Breda

Last Updated: March 24th, 2025

Content

Initial Considerations

More traders are looking to leverage their capital in the market while seeking greater security, which leads them to proprietary firms. To access the firm’s capital, however, the trader must undergo a testing period, often called an evaluation.

For a proprietary firm to be sustainable and profitable, it must accurately assess the trader’s consistency and ability to operate with the provided capital. The evaluation process must balance accessibility for traders with security for the firm.

In this article, we explore the key elements behind creating a successful evaluation model and how each factor impacts its viability.

The Role of Leverage in Evaluations

The first key factor highlighted is leverage. As a major draw for traders, its structure must be strategically planned. Higher leverage levels attract more attention but can also increase the risks for the proprietary firm (and for the trader themselves if they don’t manage risk properly).

It is common for firms to offer leverage up to 1:100, directly linked to the assets allowed on the desk (more volatile assets will require stricter control of leverage, as they can easily lead to significant losses for both parties).

Leverage above 1:100, however, is typically used to attract more aggressive traders, which results in stricter risk controls and usually comes with higher evaluation costs.

The dynamic leverage model is also used: in this case, the evaluation is split into phases that test different aspects of the trader’s skills, and as such, different leverage levels may be applied during each phase.

Practical Examples

The 5%ers takes a more conservative approach, limiting leverage to 1:10 in the Bootcamp and 1:30 in Hyper Growth. AlphaCapital allows leverage of 1:30, while FundedNext and FundsCap offer leverage up to 1:100, attracting traders seeking greater opportunities.

Loss Limits Definitions

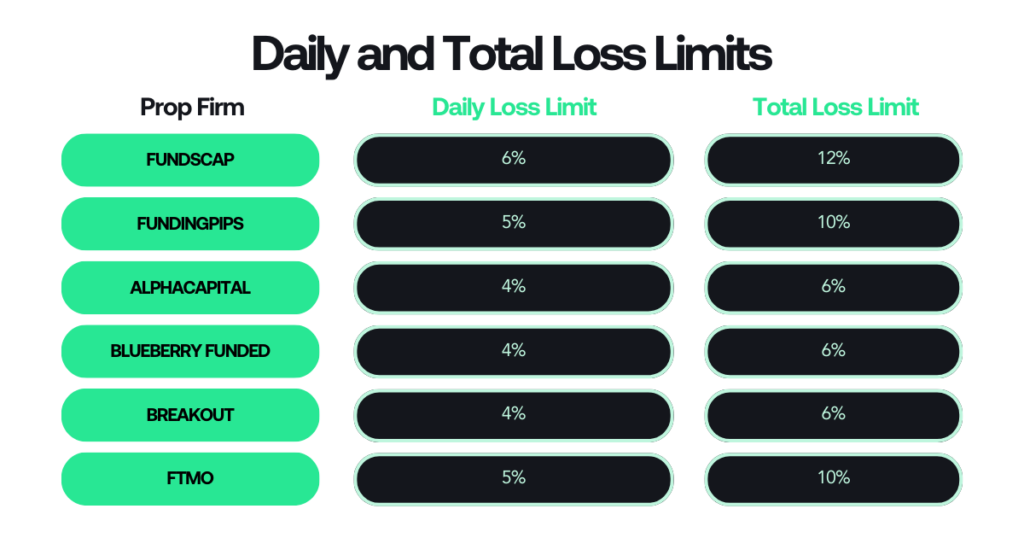

As part of internal risk control, setting loss limits needs to be precise and well-defined. Evaluations require clear guidelines, though these guidelines may change. It’s important to note that these rules are not mandatory, so not all prop firms have a daily loss limit, for example.

Daily loss limit: Usually between 3% and 5% of the allocated capital.

Total loss limit: Typically between 8% and 12%.

Progress-based adjustments: Some prop firms adjust the limits as traders move through different evaluation stages.

As mentioned, both total loss limits and daily loss limits can change. Here are a few examples:

Definition of Realistic Profit Targets

Profit targets are used to differentiate consistent and professional traders from mere spectators. Typically, evaluations set targets between 8% and 10% to balance challenge and realism, ensuring they don’t attract gamblers. After all, once funded, the trader will be using the firm’s capital, and overly aggressive behavior could put that capital at risk. Some key metrics include:

Progressive targets: Some models increase or decrease targets based on the evaluation phase.

Risk-reward ratio: Targets should be balanced with loss limits to avoid excessive demands.

Real market simulation: Creating evaluations that mimic a professional prop firm environment helps improve the quality of approved traders.

Don’t know how to set your targets?

Building a successful Prop Firm isn’t easy, but we know how to make it happen!

Number of Evaluation Phases

An evaluation isn’t just a simple A/B test. Its main goal is to assess a trader’s ability to manage the firm’s capital over time, handle market exposure, and deal with fluctuations. These days, we see firms using one-phase, two-phase, or even multi-phase evaluations.

One-phase: Simple and straightforward, this model tends to attract more beginner traders, but it can have a higher success rate.

Two-phase: The most common model in the market, as it helps filter out less-prepared traders and reduces the firm’s risk.

Multiple phases: Some firms use a three-phase system, which requires even more consistency before capital is allocated.

The choice of model directly affects the conversion rate and business sustainability. However, it’s important to note that too many phases might discourage traders from joining, so it’s essential to carefully analyze the market and know your target audience.

Additionally, some proprietary firms offer direct funding (or instant funding), where traders pay a higher fee to get access to the firm’s capital right away, without going through tests. Since there are no evaluations, many of these firms place stricter limits on capital and leverage.

Types of Accepted Assets

The selection of assets can make the evaluation more attractive and help define the profile of participating traders.

It’s crucial to keep in mind that when creating a proprietary firm, you’re running a business. Therefore, it’s essential to understand the target audience and ask questions that will guide the development of the business strategy, such as which assets will be accepted. Think of it like opening a clothing store: you need to decide whether you’ll sell children’s, men’s, or women’s clothing, or whether you’ll offer casual, formal, or athletic wear.

For your proprietary firm, you’ll need to establish: (1) the model of your firm—whether it’s focused on Forex, Futures, or B3—and (2) which assets you’ll allow to be traded within each model. Key questions to consider include:

Will you accept only Forex and Indices, or will you also allow Cryptocurrencies, Commodities, and Stocks?

Will leverage be different for each asset? More volatile markets may require reduced leverage.

Will there be restrictions on trading illiquid assets? This helps protect the firm from market manipulation.

A well-structured asset selection prevents excessive risk and ensures that the evaluation reflects real market conditions.

Allowed Trading Time

When exploring different prop firm offers, you’ll find that some impose a trading time limit while others don’t. The amount of time available has a significant impact on the trader’s experience and the overall viability of the model. Longer timeframes can appeal to more traders, as they may feel more at ease and less pressured, allowing them to trade at a more relaxed pace without rushing to hit targets.

Minimum trading days: Typically set between 5 and 10 days to ensure traders aren’t passing the evaluation with just one trade. This also helps weed out gamblers and ensures more consistent performance.

Maximum evaluation period: Usually ranges between 30 and 60 days, depending on the complexity of the evaluation model.

Time extensions: Some prop firms offer the option to purchase additional time if traders are close to reaching their goals.

Practical Examples

- FTMO: Generally requires a minimum of 4 days.

- FundingPips: Minimum of 3 days.

- Maven: No minimum days required.

- FundedNext: Offers evaluations with minimums of 0, 2, and 5 days.

- Funding Traders: Minimums range from 1 to over 40 days.

Trading During News Events

News events can cause significant market fluctuations, especially when major economic players, like the U.S. and its Federal Reserve interest rate announcements, are involved.

Many traders avoid trading during these times to avoid potential pullbacks or significant losses. However, some traders take advantage of these volatile moments, aiming for quick profits. As a result, prop firms may implement the following models for trading during these periods:

Total Ban: Many evaluations do not allow trading during high-impact news events.

Partial Restrictions: Some prop firms restrict only the most volatile events, like interest rate decisions.

Open Trading: More flexible models allow trading during news events but may include additional protections, such as wider spreads.

Trading Style: Day Trading or Swing Trading?

There are various ways to trade in the market, as we know. Some traders prefer to open and close positions within the same day (or even within minutes or hours), while others hold positions for a longer period. Evaluations need to specify whether traders are allowed to keep positions open for extended periods.

Day Trading Required: All trades must be closed by the end of the trading day.

Swing Trading Allowed: Traders can hold positions for multiple days.

Asset-Based Restrictions: Some firms allow swing trading only on certain markets, like Forex and Indices.

Offering flexibility in this rule can attract different types of traders and enhance the retention of approved participants.

Profit Split Structure

The profit split defines the percentage of the profit that the trader will retain after successfully passing the evaluation, based on the profits earned from their actual trades.

Standard Models: Typically between 75% and 90% for the trader, with the prop firm retaining 10% to 25%.

Progressive Profit Split: Some prop firms increase the trader’s percentage as they maintain strong performance.

Conclusion: Building a Sustainable and Attractive Prop Firm Model

Creating a successful prop firm evaluation requires balancing multiple factors, from risk management to trader engagement. Understanding the science behind each rule enables firms to design models that not only attract traders but also maintain the profitability of the business. By carefully structuring key aspects such as leverage, loss limits, profit targets, and profit split, firms can create an environment where both traders and the business can thrive.