There is something that you must have since you start in trading, not everyone tells you, not everyone advises you.

But it is fundamental!

If you don’t have it you’re not going to guarantee that you can actually measure your results to improve, you’re not even going to know what you’re doing ☹.

And not knowing which way to go, but wanting results is very difficult and with no one to tell you it’s much worse, right?

And that’s why you’re here, that’s why you’ve been reading for 3 minutes, wanting to find an answer and know what you really need.

Well, your time has come. What you need is a tailor-made Trading Plan that suits your tastes, but above all that allows you to achieve your results as a trader.

Did you expect it, did you already know it, had you heard it before?

Actually you have the answer to that, now that you have the answer it is time to start working for what you want.

It’s time to make money and make money the smart way.

Since you already know what you need (A Trading Plan, don’t forget) Swiset gives you a completely customizable one that allows you to organize your trading and reach your goals.

Sound boring?

Establishing a Trading Plan is the second easiest thing in the world, the first thing is to keep reading and realize how to make money with trading.

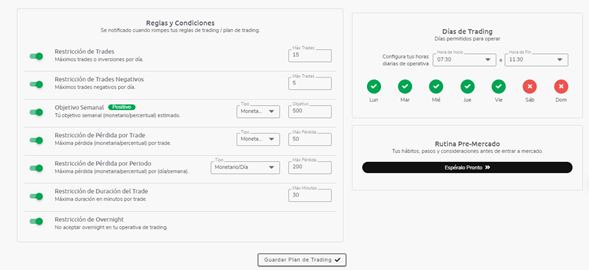

Now if we can start, the first thing you should do is to set parameters for trading. That suit your tastes and availability, not only of time but also of money.

This is your Swiset trading plan, see how easy it is? It’s not as complicated and boring as they say.

And it is the surest way to achieve your results.

What you have just seen is a sample of how to establish your own plan, it is only an example for you to guide you and set your parameters. We are not trying to tell you how to do it, but what to do to reach your goals.

Most likely you are wondering why a Trading Plan if I already have more or less my way of operating?

Well, we want to tell you a short and small story about the great majority of traders in the world.

We don’t want it to be yours, that’s why we work hard to avoid it.

You decide if you want to continue with the story or change it from today!

Now you are going to see other factors that are determinant at the moment of establishing your Trading Plan and that bring great benefits for the traders.

- Monthly risk in percentage (%).

- Weekly risk in number (#) of negative trades.

- Daily risk in percentage (%) and in number (#) of trades.

Do you know what a Pre-Market routine is?

For many traders this routine can vary, it includes from meditation and relaxation sessions to an exhaustive review of the market and the most relevant news. Each trader implements and applies different techniques in order to have an optimal emotional and mental state for trading.

In Pre-Market, it’s not just about being ready to buy or sell. It is about your workspace as a trader and your environment being in the best conditions, for that it is necessary that your mind also has an ideal state that allows you to think clearly and make the best decisions in the market.

You must find a balance and combination of practices that you can implement day by day, in order to be completely ready before trading. It’s something to do every day even when you’re not in front of the screen.

With such a routine, you have a key piece to ensure your success in your trading journey. You can include reviewing your previous day’s trading, reading the news and Overnight market behavior.

Define your patterns and structures.

Patterns and structures are fundamental when trading and establishing your trading plan. They are the ones that will determine whether to take a trade or not in the market.

To establish them you can use indicators, charts, price action and other strategies that you have at your disposal so that you can take the best opportunities that the market gives you.

Once you have tested them and know that they work, you can establish them within your plan, to take the operations that comply with these patterns and structures. Using the same fundamentals to take a trade will be key to measure your results, since from them you determine if they really work or if on the contrary you should improve them to have better results.

Choose your financial assets

It is essential that before sitting in front of the screen you have established which assets or instruments you are going to operate. There are a great number of assets, but there are some that adjust much better to your plan as a trader, your financial goal or your way of seeing the market.

Some assets have greater daily fluctuation of its price than others, so if you are a trader who takes intraday positions or more aggressively as a scalper trader you must identify which assets benefit you more and adapt to your way of operating.

Likewise, the market is moved by the news and novelties that are presented in the world. It is your job to know how to react to them, if you take operations before, during or after the news happens because some assets are more affected by the news than others.

What time to trade?

It is important to establish days and hours of the day in which you are going to perform as a trader, some days you will have higher profits than others and it is your duty to identify on which day and at what time the market brings you more benefits.

How do you know which day and what time? It’s easier than you think!

With Swiset you get the precise information of what day and what time you should be in front of the market, through our statistics and the Trading Mentor you can know this information comes from your own operations, you only have to worry about registering.

For every trader is essential to establish your schedule and trading days, because your time is your most valuable resource and you must use it as efficiently as possible. Staying all day watching will not only make you lose valuable time, but also the tiredness and eagerness to take a trade can lead to mistakes.

If, on the other hand, you know what time and what day to trade you can make better use of your time to make your other commitments and to enter the market at the right moment when you are going to make a profit.

Want to learn more? Find out more in our Blog on “The 3 statistics to increase your average profit”.

Do you manage it or wait for the close?

Every trader must be absolutely clear about this!

Before you start trading you must know what you are going to do with your operations, if you manage the pivots, or until your last support or resistance, even until the breakeven. It depends entirely on your taste, but it is important to know.

Or if on the contrary you are going to enter a trade and wait for it to close either target or stoploss, it is something you should evaluate and study.

How to know whether to manage or not? Well we have a very quick tip and it is that you write down what happened in the trade once it ends, whether you managed or not. With these notes you will know for the future what really benefits you more.

With Swiset you have the possibility not only to record the trades automatically once they close, you can also make notes and even add a screenshot to know more precisely what happened.

How much are you willing to risk?

It is true that the more you risk the more profit you can get, but the real question is what is the chance that you can win?

In trading, in life and investments there is always a risk either the risk of winning or losing, but there is always risk and it is something that you must be clear if you are a trader. What is really key is to manage in the best way the risk you are willing to take.

How about risking 10% of your account today? And so for a week, we are talking that in 5 days you have already risked 50% of your account and if your trades have been losing you have already lost half of your initial deposit. Doesn’t sound so good, does it?

That’s why you should be concerned about measuring and being aware of how much you are risking on a daily basis. Besides being very clear about how much you risk in each operation and that what you risk is much less than the chances you have of winning.

The only way to know all this is to measure, to get your statistics and to establish how much you plan to risk in your operations. Managing your risk is what will determine how profitable you are or can be in the short and medium term.

By having a complete record of your trades you can measure yourself, draw your own conclusions and implement them into your Trading Plan. With Swiset it is very simple! Swiset allows you to register your trades automatically and provides you with your trading statistics, so you can establish the risk you are going to assume and guarantee your profitability.

The day is over and it's time to review it.

Applying everything we have just told you, you have enough tools to achieve consistency and profitability in 3 months hand in hand with Swiset, in addition to following the recommendations provided by your Trading Mentor and constantly registering your operations in Swiset.

Today you start your way to consistency and profitability as a trader, you have in your hands a tips and a professional tool that allows you to achieve all your goals and objectives as a trader. Today you have the opportunity to be better than you were yesterday. What are you waiting for to start?

Regístrate hoy en Swiset y obtén los beneficios que todos los traders sueñan tener.

Aplicando todo lo que te acabamos de contar tienes las herramientas suficientes para lograr la consistencia y rentabilidad en 3 meses de la mano con Swiset, además de seguir las recomendaciones brindadas por tu Mentor de Trading y registrando constantemente tus operaciones en Swiset.

Hoy inicias tu camino a la consistencia y rentabilidad como trader, tienes en tus manos una tips y una herramienta profesional que te permite alcanzar todas tus metas y objetivos como trader. Hoy tienes la oportunidad de ser mejor que lo que fuiste ayer ¿Qué esperas para iniciar?