Trading and misinformation

In today’s fast-moving and constantly evolving financial markets, it can be difficult to separate fact from fiction. With so much information at our fingertips, it is important to know how to distinguish credible sources from those that are not. In this blog, we explain some of the negative effects of misinformation on investors and the markets as a whole, as well as some tips that can help you protect your capital.

The first negative effect is loss of confidence:

Misinformation can cause traders to lose confidence in the market, in the companies they are investing in and in themselves. This can lead to a reduction in demand and, in turn, a fall in prices, which can negatively affect market liquidity. In addition, if a trader feels uninformed or confused, they are less likely to have confidence in their own abilities and therefore their trades are less likely to be profitable.

Another negative effect of misinformation is excessive volatility:

Sometimes fear and panic instilled by false rumors create volatility in the markets. This can make it more difficult for traders to predict the performance of their trades and in the short term risk increases which can lead to imprudent investment decisions and significant losses.

A third negative effect is a lack of transparency:

Misinformation can hide the true financial situation of a company or the market in general, making it difficult for investors to make sound decisions. It is well known that some malicious actors seek to manipulate markets for their own benefit. This can include insider trading, pump-and-dump schemes and other forms of fraud. These activities can harm not only individual investors, but also the overall health and stability of markets.

A good example of this is the 2013 “Penny Stock Scandal”, where BAL investors were induced to buy low-priced, risky stocks through false and misleading statements made by company insiders, promoters and others. The result was a huge loss for many people, who were left with worthless shares.

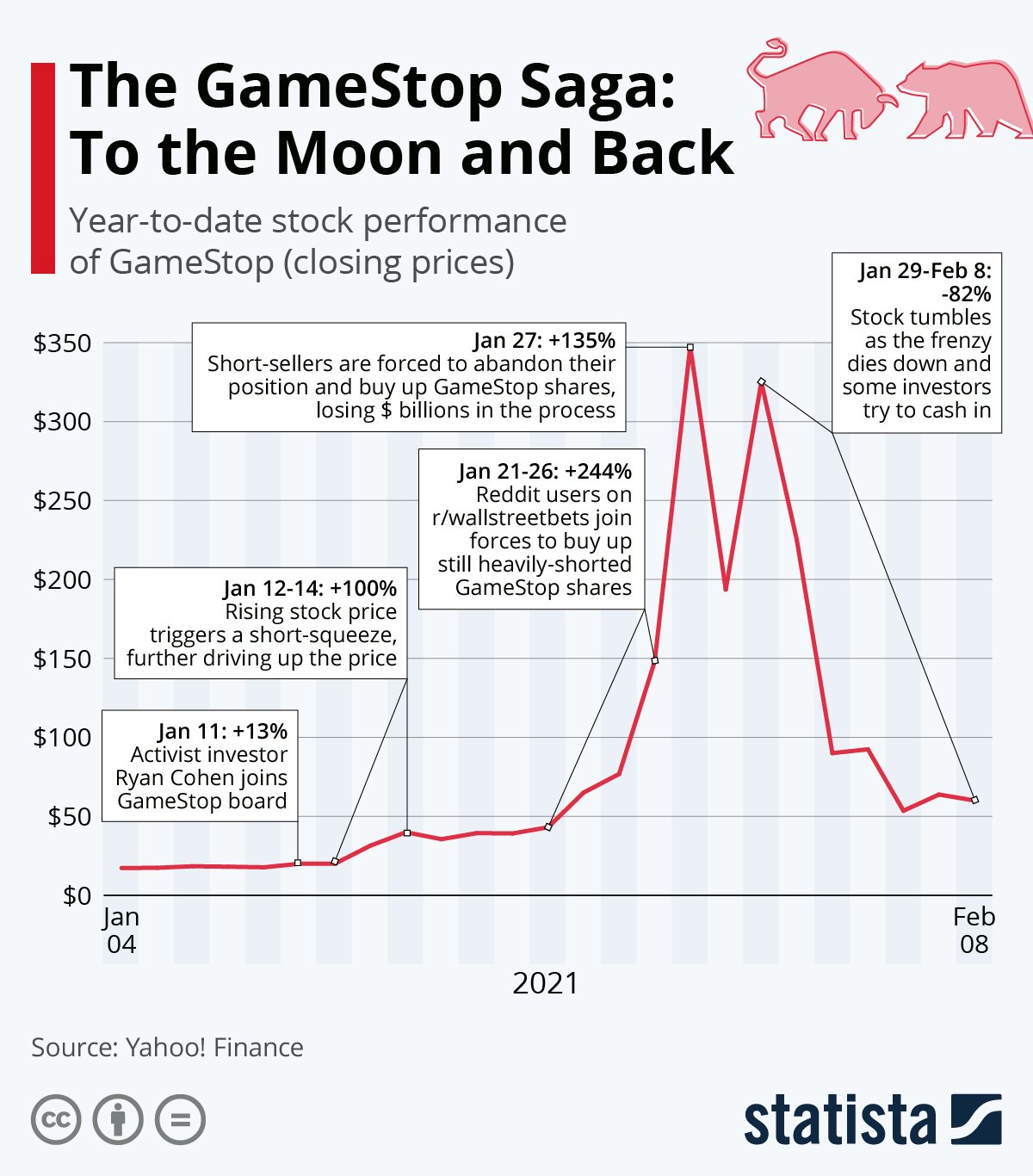

Another example of manipulation is the “GameStop Mania” in 2021, where the hype around the video game retailer caused a huge stir in social media and online forums, which ended up driving up its share price without any real basis, resulting in significant losses for investors who bought at the peak and also for those who sold short.

These examples demonstrate that if investors do not have access to accurate and timely information, they are more likely to make bad investments and suffer financial losses.

So, how can you protect yourself from misinformation in trading?

- One of the most important steps you can take is to be sceptical of information that seems too good to be true or that comes from unreliable sources. Always do your own research and consult a financial advisor before making any investment decisions.

- Another important step is to stay informed about the markets and companies you are interested in investing in. This can help you spot red flags and avoid getting caught up in speculation.

- Be aware of the risks of social media and online forums, which can be a breeding ground for misinformation. Be cautious about accepting investment advice from strangers on the Internet, and be aware of the possibility of fraud and scams.

In conclusion, misinformation in trading can have serious consequences for investors and the markets. By being sceptical, staying informed and protecting yourself from misinformation, you can make better investment decisions and avoid the risks of it. Remember, always do your own research and never invest in something that seems too good to be true.

Sergio Olivares

Research and Development Manager