Fintech, the word with nearly 100 million results on Google, today sounds like one of the biggest promises in a sector of the economy centralized by large and historic institutions.

What is Fintech?

Etymologically it lies in the conjunction between the various financial products or services (End), with technology solutions (Tech).

I always like to put the term ‘technologies’ aside when it comes to something specific. It is usually widely used, and in its purest sense it connotes any advance, but for this century we know that the technological component of the term refers more to computer and software systems.

How it is perceived throughout the last decade, where financial services and products have accelerated their digitization like never before. This implies from banking through mobile applications, to fast-factoring processes on web platforms.

It is NOT just Banking

The same universe of the financial system spans multiple verticals. In the same way, this movement is very plural and includes a compendium of verticals such as:

- Banking: Neobanks or Open banking services.

- Payments and Remittances: Payment gateways, money orders and other applications that facilitate money transfers or the payment of financial obligations.

- Personal or corporate loans: Financing Systems for legal or natural persons. From Factoring to Microcredits.

- Financial Markets and Trading: Platforms to facilitate investment access to the great masses. Raid without the need for many barriers to entry.

- Management software: Accounting or payroll management software.

- Current landscape of the ecosystem

- An ecosystem is made up of much more than companies. It is a whole set of dynamics and nodes that collaborate with each other to satisfy the demand of the segment.

Current landscape of the ecosystem

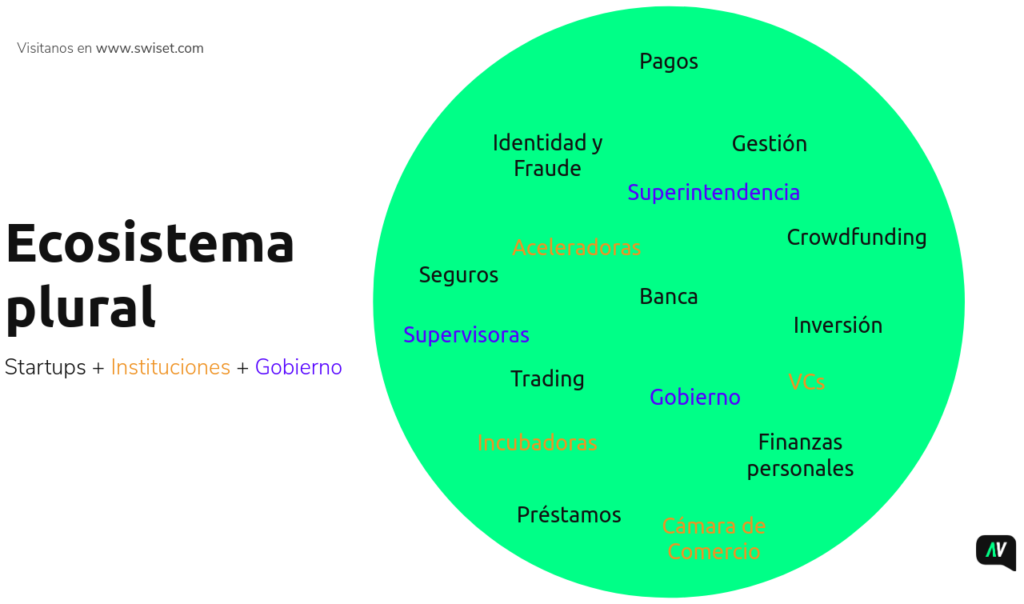

An ecosystem is made up of much more than companies. It is a whole set of dynamics and nodes that collaborate with each other to satisfy the demand of the segment.

In this way we find ourselves in an ecosystem where startups create products / services, which coexist in contexts with rules of the game dictated by regulatory entities, while being catalyzed through accelerators or VCs (Venture Capital Funds).

Regulatory entities such as Superintendencies or Control Commissions are often left aside in the process of creating startups, but it is important to think about the implicit responsibility that most financial products and services have. This maximizes the power of strategies such as, for example, the sandboxes of the Financial Superintendency of Colombia, which offer validation in various product verticals that leave both consumers and startups calm about their operation.

Global perspective

Across the sphere, according to the annual report of the PWC, 53% of the fintech companies mapped are from Banking and Capital Markets, 22% are from Insurance and 18% between Payments, Remittances and the like. The big fintech ‘producers’ are still the US and the Euro Zone.

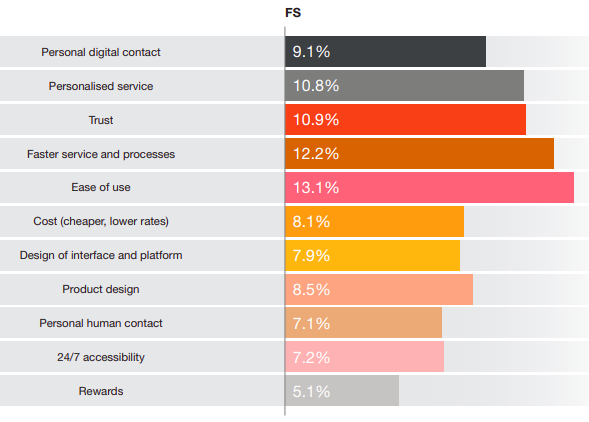

Quickly, through the same report, we understand that the main value of fintech companies lies both in the ease of use (User Experience) and in the agility of the service and processes. It sounds relentless as factors that were not so important in product design before are now an essential part for the financial consumer.

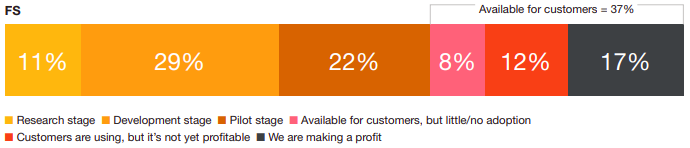

Likewise, we identify that the vast majority are still in the early stages of the market. It is consistent to find this insight, knowing that Fintech is a vertical with pronounced brotherhood to 4.0 technologies (Augmented Analytics, IIoT, Data Science, etc.). Technologies where there is more experimentation than true maturation.

And how is the bullfight going in Latin America?

To date, excluding Brazil, the economies of the Latin American region continue to be part of the group of emerging economies.

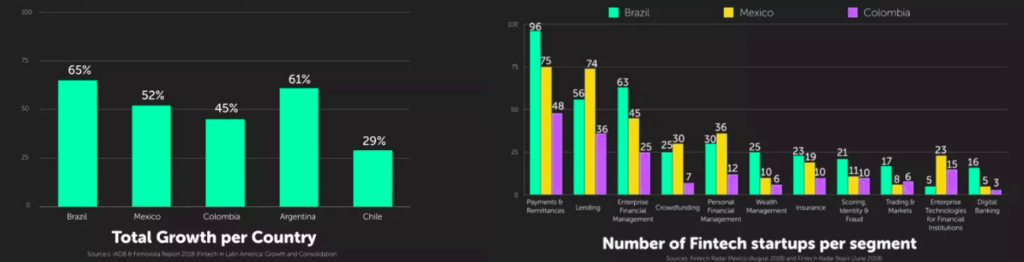

The last 5 years have been of hypergrowth for fintech companies in Latin America. Through Finnovista and its fintech radars, we find that Brazil, Argentina, Mexico and Colombia have 55.75% average growth, and better, approximately 37% of them are in the Growth and Expansion phase.

Even more gratifying, we find that according to data from the Inter-American Development Bank, it is estimated that about 40% of fintech companies in Latin America have financial inclusion as their main objective for both individuals and MSMEs. Starting in this way with efficient and comprehensive financial services, it will be easier to transform highly extrativist economies into more creative / talent-based dynamics.

What will be the predictions in Fintech?

It is always a risk to venture to see a panorama in this sector, but it becomes less complex when playing with the numbers of what the world will probably demand in 10 or even 30 years.

Identity and fraud

Everyone wants to catalyze this digital transformation in the financial sector, but there is one main bottleneck that certainly limits developments: the authenticity of financial issuers and consumers.

To put a simple example; It sounds very nice, and even chimerical, to think of a world where the coverage and opening of any line of credit is solved in a matter of minutes by a digital channel. However, when validating the authenticity of the people, whether natural or legal, who use the bank’s digital tools to request the credit line in their name, we find the real dilemma.

Worse still, if all valid techniques are found to consistently authenticate identity, a new problem arrives: fraud.

By progressively solving both identity authentication and fraud, thousands of digital solutions in the industry that previously seemed unfeasible are clarified. Roundly.

Financial markets

The current reality of financial markets from a technological perspective, has a high demand towards the democratization of investment.

The large influx of investment on various financial assets and derivatives, has made that even an ordinary citizen can buy shares or currencies from any computer with internet access, but it is still missing.

The democratization process implies not only finding more alternatives to invest in a market that is extremely plural, but also the responsibility of creating technologies or tools that facilitate financial recommendation and risk management. It sounds logical, if you increase accessibility on more exotic / risky assets, you should increase education, guidance or financial management to avoid crashing when venturing with them. Hopefully it’s a sensible balance.

An example of this is Swiset, a Colombian startup that fully facilitates risk and capital management to independent traders / investors, or Tyba, a platform that agilely builds investment portfolios according to risk profiles.

It should be remembered that the vast majority of technology has been and will be planned in order to solve beneficial needs for humanity. This great ecosystem is no different, its multiple nodes have the main objective of transforming into efficiency a current system that is full of vulnerabilities, procedures, and both cumbersome and exclusive procedures. Step by step.

Camilo Tobar.